ADAPT Intraday SPX Options

Life and Markets Are Complicated Enough, Intraday Options Trading Doesn't Need to Add to It.

Intraday SPX Calendar Options Trades Using a Proprietary Allocation Model.

Designed With Simplicity In Mind

Time Required To Place & Manage This Trade:

Active at the Open, needs monitoring throughout the day.

We enter one trade each morning, at the open.

These trades need to be monitored as long as they are open.

This is sometimes as little as five minutes, but more often they are open most of the day.

All ADAPT Intraday trades are non-adjustment, making the system simpler to follow

The system is perfect for the trader that likes to wake up early and trade with a set plan.

Most trades exit within hours of the open and some take only minutes.

What is the ADAPT Intraday Metric?

ADAPT (Intraday) is an options strategy that focuses on rapid options decay and volatility shifts in various SPX options’ expirations.

The massive forces in the options market for various structures and strategies create major profit potential.

We capture that profit with our proprietary environmental algorithms and professional-level risk management.

ADAPT Intraday Options’ metric is a powerful trading tool that's designed to help you stay ahead of the curve in ever-changing market conditions.

With its Intraday algorithm, the ADAPT Intraday Options System identifies the best options trading strategies for the current market environment, so you can make more informed decisions and maximize your profits.

ADAPT Intraday is a powerful trading tool that utilizes machine learning and artificial intelligence to identify profitable trading opportunities.

It uses historical data and real-time market analysis to make predictions and provide recommendations based on your individual trading style and preferences.

What is the Environmental Concept?

We wouldn’t wear shorts in Antarctica and we wouldn’t wear a jacket on a hot beach.

We also don’t enter the same trade for all days in the market. Every day in the market brings different weather.

Our ADAPT Intraday trading system uses our proprietary environmental algorithms to determine the optimal trade with maximum efficacy for the current market conditions.

Every day has the potential to change the expirations, profit targets, loss limits, and strikes. ADAPT (Intraday) is truly the trade system that changes with the market.

Why SPX Calendar Spreads?

Through our extensive backtesting and live trading experience, we discovered the secret of balancing all aspects of a trade. Risk, Volatility, Expiration exposure, and more.

The more we balanced the more we realized calendars have significant advantages over traditional vertical-based strategies in various market conditions.

Consistency is the key to long-term success in options trading. Using calendars that have high decay, balanced greeks, and are properly risk-managed is our way of achieving consistency across all market environments.

A System Designed With Built-In

Risk Management

The largest gap between retail and professional trading is proper risk management.

It's complex, and it’s hard to understand why it’s so important and because of that retail traders don’t do it, or do it wrong.

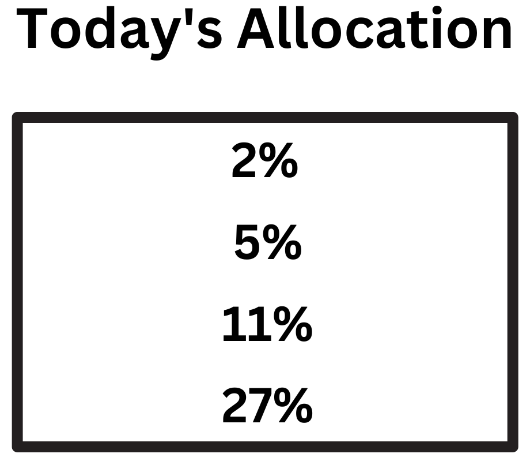

We let our historical trade data of over 10,000 data points determine our risk. This creates our proprietary allocation model.

Our risk model simplifies all those complex risk calculations into a simple number. That number is the optimal trade size specific for that day and the current market environment to grow an account at the maximum rate.

Want to learn more?

FREE Courses |

Options Behind the Scenes

After signing up, you get access to more than just the trade that day!

You will also instantly receive…

Introduction videos to get you started

Access to the community forum and hundreds of like-minded traders

Priority level service from our team

Pre-Market trade setup per our environmental algorithms

Up-to-date realized gains and losses on a per-trade basis...And More!

Benefits of SPX Trading

SPX Options are a fantastic choice for options traders due to their tax-advantaged 1256 rules.

SPX options gains are taxed as 60% long-term gains and 40% short-term gains.